Top Story

Low-Density Rental Housing in America

The report codifies the SFR market’s language, product types and characteristics for this rapidly expanding and evolving market.

The Curtis Infrastructure Initiative conducted a survey of Urban Land Institute members to better understand perceived quality and infrastructure priorities by the real estate and land use industry as well as how infrastructure investment will affect real estate development trends.

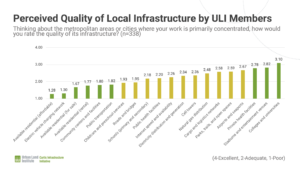

The survey asked multiple-choice questions designed to better understand ULI members’ perception of the quality of infrastructure as well as priorities for investment within the metropolitan area or areas where they primarily work. ULI member responses show that the perceived quality of colleges and universities, stadiums and entertainment venues, and private health facilities was rated the highest, while the quality of available residential (subsidized, income qualified, or social housing), the electric vehicle charging network, community centers and facilities, and public transportation was rated the lowest. Available for sale and rental housing, beyond just affordable (subsidized, income qualified housing or other social housing program), also was rated as below adequate.

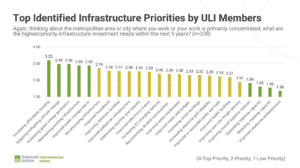

The highest infrastructure priority identified by ULI members overwhelmingly was increasing the stock of affordable housing. This was followed by adapting to and mitigating climate change, increasing renewable and green energy generation, and improving public transportation. Low priorities identified were improved stadiums and entertainment venues, both reducing and expanding roadway capacity, and improving the overall logistics network. Improving last-mile freight delivery was within the margin of error being rated a priority. However, it is not as high as the other infrastructure categories that were all ranked at least as a priority or higher.

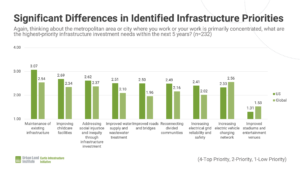

The most striking difference between the U.S. and global ULI member responses was that maintenance of existing infrastructure was rated by U.S. members as a significantly higher priority than by their global counterparts. This put maintenance of existing infrastructure within the U.S. members’ top five priorities whereas this was not within global members’ top five priorities. Instead, decarbonizing existing and new infrastructure was one of their top priorities.

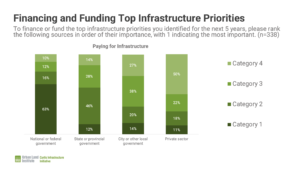

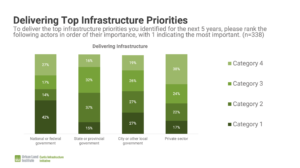

To implement these priorities, overwhelmingly, ULI member respondents identified the national or federal government (63 percent) as the most important source of funding for the top infrastructure priorities identified. Conversely, the private sector (50 percent) was identified as the least important source in financing or funding the top infrastructure priorities.

ULI members’ responses for delivering those top infrastructure priorities identified were more mixed and complex. The national or federal government (42 percent) was identified as the most important and the state or provincial government (15 percent) was identified as the least important in project delivery.

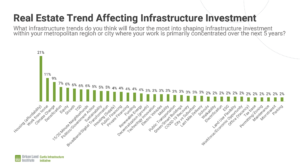

Finally, ULI members were asked “What infrastructure trends do you think will factor the most into shaping infrastructure investment within your metropolitan region or city where your work is primarily concentrated over the next 5 years?” Housing affordability, changes as a result of COVID-19 such as work from home, and climate change were the most mentioned real estate trends impacting infrastructure investment.

Click here to read the full findings including how ULI member respondents defined infrastructure. Learn more about the Curtis Infrastructure Initiative and how to join our movement to implement equitable, resilient infrastructure investment that builds long-term community value.

Don’t have an account? Sign up for a ULI guest account.