The Materials Movement: Creating Value with Better Building Materials

Incorporating non-toxic and low-carbon building materials will be key to real estate’s journey to net zero and the creation of healthy, sustainable, and equitable communities.

Building materials are increasingly becoming a priority for real estate leaders looking to reduce the environmental and human-health impact of their buildings.

The data tell a clear story: building materials contribute around 11 percent of global carbon emissions every year, and often contain chemicals and other substances that harm people and ecosystems.

The good news is that real estate leaders around the world are making smart choices about materials to reduce carbon and improve health, all while achieving strong financial returns.

ULI’s report, The Materials Movement: Creating Value with Better Building Materials, details this shift and provides an introduction for real estate owners, developers, and investors looking to integrate better materials and achieve sustainability, health, and financial goals.

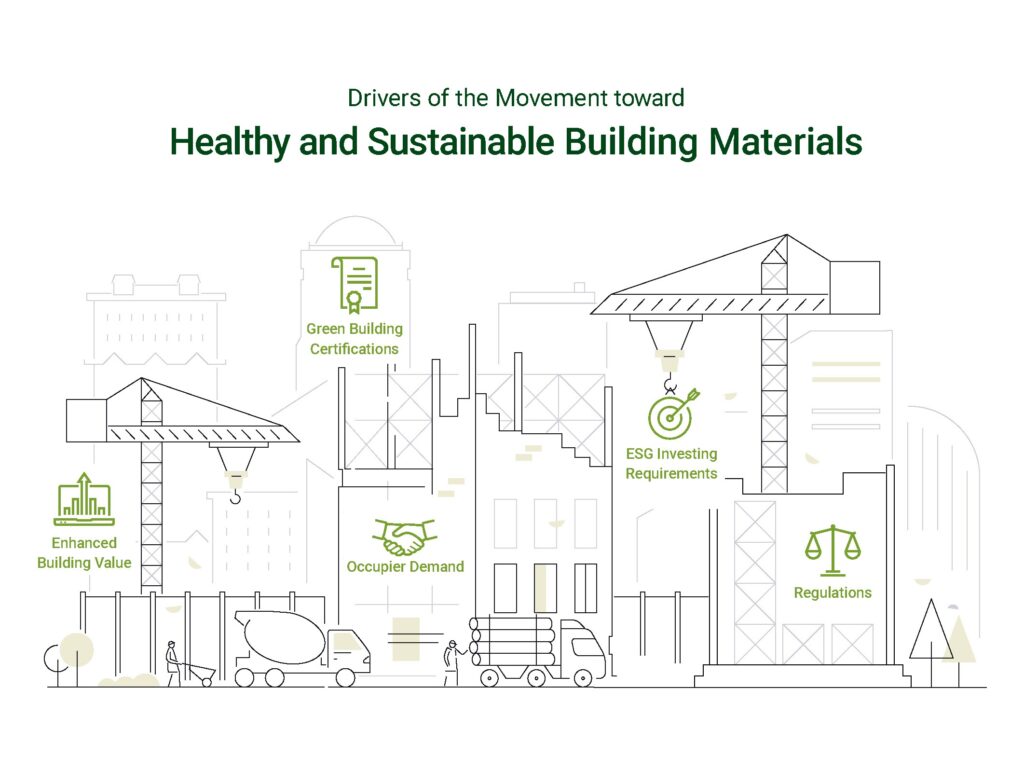

Incorporating better materials in real estate can help maximize financial returns while delivering social and environmental benefits to tenants, communities, and real estate itself. Market drivers that are encouraging the industry’s shift include the following:

Regulations. New policies and financial reporting requirements for embodied carbon and certain chemicals are pushing the industry to integrate low-carbon and nontoxic materials in buildings.

Green building certifications. Nearly every prominent sustainable building certification program includes requirements for embodied-carbon reporting, chemical avoidance, or ethical material sourcing.

Occupier demand. Integrating healthy, low-carbon materials in buildings can make assets more attractive to sustainability-minded tenants, who increasingly desire spaces that promote wellness, productivity, and cognitive performance.

Enhanced building value. Incorporating better building materials into a project can increase a development’s value, especially if the project achieves a healthy or green building certification.

Environmental, social, and governance (ESG) investing requirements. As investor interest in ESG intensifies, real estate owners and developers are increasingly including building materials as part of their sustainability targets.